“Okay so the bill of material is about USD360, we sell it at about USD450, So our profit margin is, if you remove all the kind of shipping logistics and giving some of that margin to channel partners like carriers or Amazon or whatnot, OUR MARGIN IS ZERO. After we have launched this product (phone1), now we have shipped half a million of these and now suppliers are budging. We are getting better and better pricing. So our future products, OUR MARGINS WILL ALSO START GROWING”

~Carl Pei in 2022 (Source: Youtube Video)

Looks like this is turning out to be true atleast for the Indian entity of Nothing. As a recap, Nothing India publishes its financials annually and if you remember, the entity was not profitable (on underlying basis) in FY23 (April’22 to March’23) Detailed analysis of last year here

As Carl mentioned in the above quote, things are improving, margins are improving. Nothing India is actually making money on every unit sold. IT IS FINALLY PROFITABLE, on underlying basis i.e. without any financial support (subvention) from holding company.

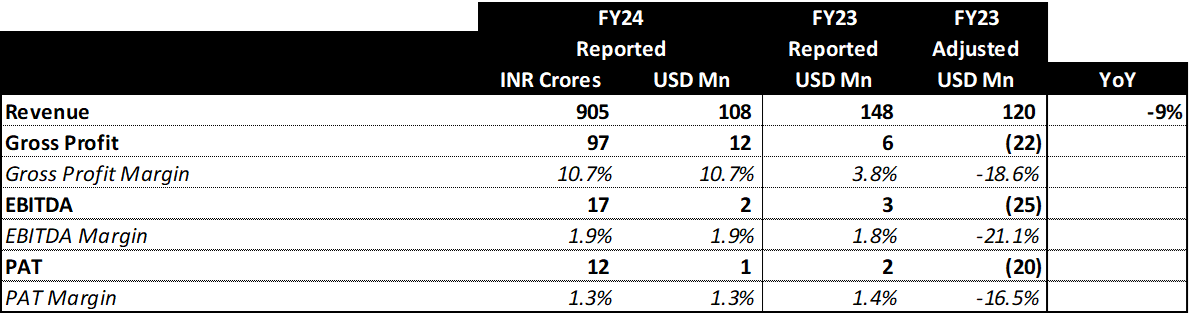

Here are the summarised financial:

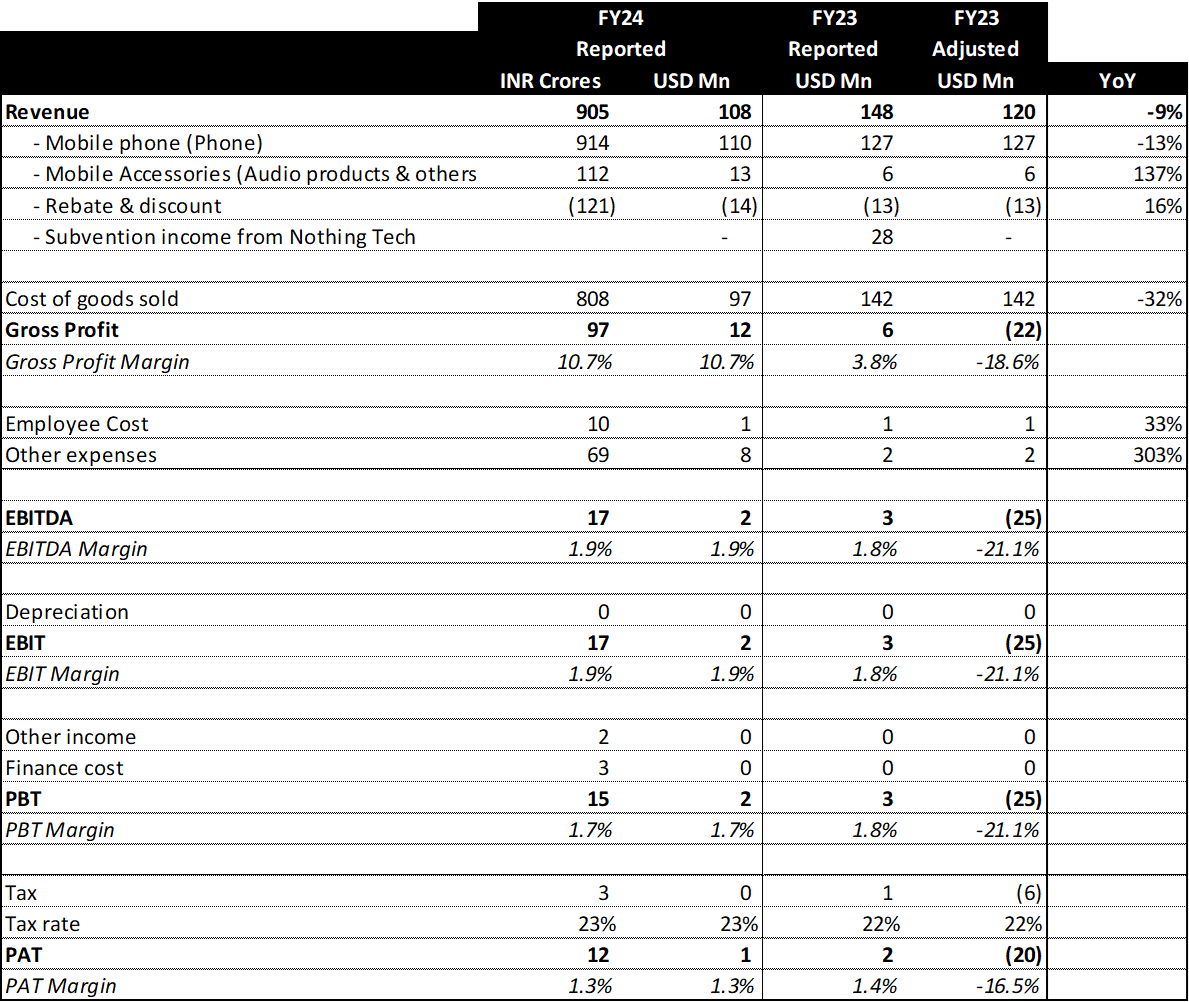

During FY24, it reported total revenue of INR 905 crores (USD 108mn), EBITDA of INR 17 crores (USD 2mn) and profit after tax of INR 12 crores (USD 1mn), While the revenue declined 9% YoY, the profitability profile improved significantly. From making almost 20% loss on material cost itself (i.e. gross profit) last year, now it is making 11% gross profit. So, now Nothing is not selling Phones below Bill of Materials (BoM). Even it is now able to absorb the overheads (employee cost, other expenses, advertising) and still make a positive EBITDA, albeit only 2%. But being breakeven within 3-4 years of operation, IS AN ACHIEVEMENT IN ITSELF. Still many startups in India, even after getting IPOed also, are still loss making machines. Great job by Nothing India, I must say.

Coming to the revenue, it declined primarily led by decline in mobile phones sales, while the accessories (audio products, wearables etc) performed significantly better by more than doubling their revenue. Considering the products launched in FY24, looks like that the Phone (2) sales were much lower than Phone (1) and that is understandable given the high price point of Phone (2). Additionally, taking in account that Phone (2a) also launched in FY24, while only in the last month but it sold more than 100k units globally in March 2024 within a matter of hours, the Phone (2) sales must be quite low.

On the accessories, looks like the launch of Ear (2), CMF line-up (Buds Pro, Watch Pro, GaN charger, Buds) did quite well, thus doubling the revenue. Btw, CMF Phone 1 launched post the closure of FY24, thus its revenue is not captured in this.

Full Financials:

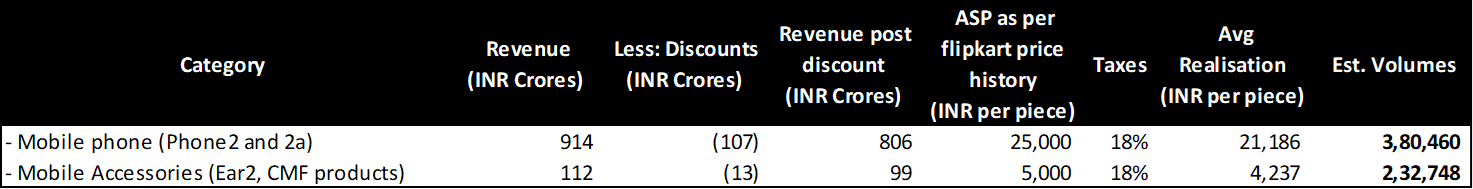

Estimated product wise volumes:

Similar to last year, if we try to estimate the product wise volumes, looks like Nothing India sold about 400k mobile phones and more than 200k accessories in FY24. Refer last year’s post to better understand the estimation approach followed.

Some other observations:

- Pickup in sales & marketing expenditure: Encouraging to see that Nothing India efforts on sales and marketing have improved substantially. Its marketing expenditure increased 165% to INR 25 crores (USD 3mn) i.e. now 2.7% of revenue vs only 0.9% of revenue last year. I think it was bound to increase given higher advertisements we have seen, India launch events and hiring of Ranveer Singh as the brand ambassador for Phone (2a). Considering the early stage at which Nothing brand is there, I think this expenditure needs to further increase. Even nowadays mature companies spend 3% of revenues on advertising. Aggressive companies spend 15% of revenue and startups spend even 40%+ on advertising.

- Imports increasing but in line with accessories sales: CIF value of imports almost doubled implying much higher imports by the company. I think it is understandable considering more than doubling of accessories revenue as these things must be coming from China for Nothing India. May be Nothing now should evaluate manufacturing these also in India, along with its existing Phone manufacturing. Recent Indian pricing of Nothing accessories pricing have been on increase along with limited availability (for example, high pricing for Ear 2024 and Ear Open), which can be improved with Indian manufacturing.

- Exports still zero: As mentioned in last year’s post, exports from India continues to be zero. That means, Indian manufactured products are solely being sold in India. Given now Apple is also shifting supply chains to non-China markets, exporting from India can be a big opportunity. Even Carl recently in his interview at TechCrunch (interview link) has also talked about experimenting exports from India manufacturing facilities in an year.

- Warranty & rebate provision: Provision increased by INR 42 crores (USD 5mn) which is 4.6% of FY24 revenue. Looks like a decent number for warranty claims.

- Subvention / Support from Nothing Tech: Unlike last year, in FY24, Nothing India has not considered any income subvention / support from the holding company, mostly because now the Indian entity is profit making. While it still has last year’s income subvention as receivable on the balance sheet, it was reduced a bit. Looks like Indian entity has received some last year’s support this year and has also written off some of the amount (INR 18 crores or USD 2mn) as a loss. It seems that this amount will be over a period of time be reduced by considering as a loss, because as mentioned in last year post, Nothing India had paid taxes on it last year. Considering it as a loss now may net it off going forward. But, in short, Indian entity is not requiring any more financial support from global unit, which is a big positive.

- Royalty payment: Biggest thing to prove that Nothing India is doing well is from the fact that it has started paying Royalty to the holding company. FY24 was the first year when India entity paid Royalty. It paid INR 11 crores (USD 1mn) i.e. 1.2% of revenue. 1-1.5% royalty to the brand holder is quite common for MNCs in India where the India unit is using the global company brand.

In summary:

FY24 financials reveal a significant milestone for Nothing India, marking its first profitable year on an underlying basis. Despite a slight dip in overall revenue, the company’s improved margins and became self-sufficient. Investments in marketing, increased accessory sales, and the initiation of royalty payments to the holding company.

Nothing India’s journey to profitability within just 3-4 years is commendable and points to a robust future.

Thanks for spending time on reading this long one. Please note, the above analysis is my personal one and is based on many assumptions, thus it may or may not match with business underlying performance.

Excel attached

What do you think about this financial performance? What do you think Nothing should focus on now, particularly in India? Let’s discuss in comments ⬇️